CFD Trading with Cryptocurrencies: Exploring Digital Assets

cfd trading has become a well-known investment choice for a lot of investors. It is a quick and simple strategy to industry different resources, which include stocks and shares, indices, and products. CFDs let forex traders to speculate on the selling price motions of primary resources without actually having the tool. The opportunity of higher earnings and the ease of accessibility have captivated many traders to the form of trading. Within this comprehensive manual, we will explore all you need to know about CFD trading, from standard concepts to sophisticated strategies.

1. Comprehending CFDs:

CFD is short for Agreement for Distinction, and it is a legal contract between two events. The consumer agrees to cover the seller the main difference between your opening and closing costs of any tool. CFDs are leveraged items, and therefore investors can industry with a small amount of capital but still handle bigger industry styles. The leveraging utilized in CFD buying and selling can magnify the returns, but it may also boost the danger of loss. Therefore, it is very important understand the hazards involved in CFD trading before committing any cash.

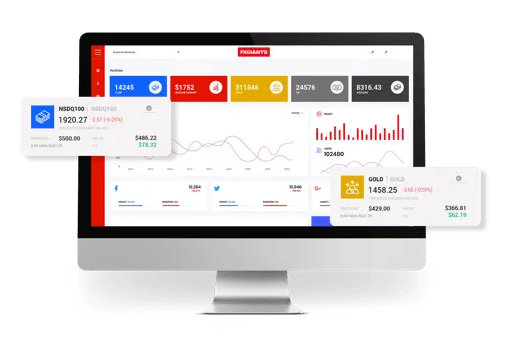

2. Deciding on the best agent:

One of the essential techniques in CFD forex trading is deciding on the best dealer. The broker that you simply opt for could affect your current trading practical experience. You must select a dealer that gives a reliable forex trading system, competing spreads, lower commission rates, and fast setup. It’s important too to select a broker that is regulated by way of a reliable influence to ensure that your money are safe.

3. CFD Trading Methods:

There are numerous trading strategies that dealers can make use of to increase their revenue and reduce their hazards in CFD forex trading. Some well-liked tactics involve tendency pursuing, golf swing trading, and scalping. Trend adhering to requires after the pattern from the marketplace and consuming positions toward the trend. Swing buying and selling consists of capturing simple to method-phrase imbalances available in the market. Scalping involves generating repeated trades, benefiting from tiny cost movements on the market.

4. Chance managing:

Threat managing is very important in CFD trading. Traders should use quit-decrease requests to restriction their losses in the event the market place techniques against them. It’s also important to get a suitable forex trading prepare and stick to it. Traders should not chance more than they can manage to drop and really should not permit inner thoughts management their trading decisions.

5. Education and learning and employ:

Training and rehearse are definitely the tips for success in CFD forex trading. Forex traders should learn up to they could regarding the marketplaces, buying and selling tactics, and chance control. They must also exercise investing on the demonstration accounts before making use of real cash. This enables them to get practical experience and check their strategies without endangering any capital.

Bottom line:

CFD investing can be a great expense option, but it also comes with threats. To turn into a productive CFD forex trader, you need to understand basic principles of CFD buying and selling, choose the right broker, use powerful investing tactics, and rehearse suitable danger control. With determination, self-discipline, and training, you can master CFD forex trading and achieve your economic objectives.